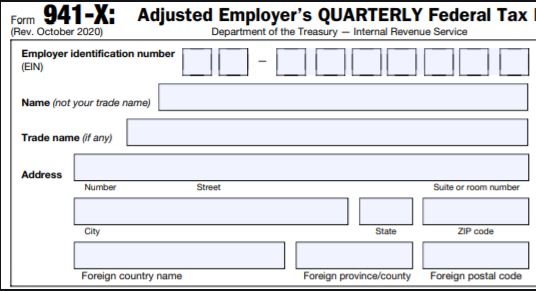

Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, is the form employers use to correct errors on a previously filed IRS Form 941. There have been new laws and recent IRS changes making this form necessary.

A couple of examples would be a missed tax credit related to COVID for sick leave, or care for a family member, Employee Retention Credits for eligible wages, or last minute legal changes.

You can click here to view this form and read more about it.

Source: Internal Revenue Service